Returns on Investment

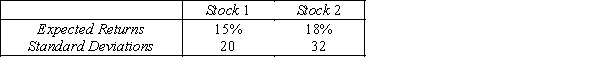

An analysis of the stock market produces the following information about the returns of two stocks.  Assume that the returns are positively correlated with correlation coefficient of 0.80.

Assume that the returns are positively correlated with correlation coefficient of 0.80.

-{Returns on Investment Narrative} Find the standard deviation of the return on a portfolio consisting of an equal investment in each of the two stocks.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q182: The following information regarding a portfolio of

Q183: Risky Undertaking

Suppose you make a

Q184: Which of the following regarding the mean

Q185: Risky Undertaking

Suppose you make a

Q186: Elizabeth's Portfolio

Elizabeth has decided to

Q188: Elizabeth's Portfolio

Elizabeth has decided to

Q189: Elizabeth's Portfolio

Elizabeth has decided to

Q190: Katie's Portfolio

Katie is given

Q191: Elizabeth's Portfolio

Elizabeth has decided to

Q192: Katie's Portfolio

Katie is given

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents