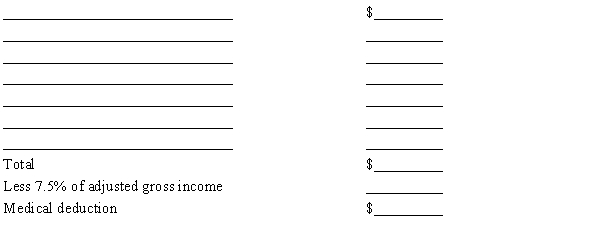

During 20187, Sarah, age 29, had adjusted gross income of $12,000 and paid the following amounts for medical expenses: In 2018, Sarah drove 139 miles for medical transportation in her personal automobile, and she uses the standard mileage allowance.Her insurance company reimbursed Sarah $300 during the year for the above medical expenses.Using the schedule below, calculate the amount of Sarah's deduction for medical and dental expenses for the 2018 tax year.

Correct Answer:

Verified

\text { Medical...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q33: What is the difference between the tax

Q34: If an employer makes a contribution to

Q38: Christine is a self-employed graphics artist who

Q40: Wilson and Joan, both in their 30s,

Q45: Which of the following is not deductible

Q46: Randy is advised by his physician to

Q47: In 2018, the adjusted gross income (AGI)limitation

Q56: The cost of over-the-counter aspirin and decongestants

Q58: Which of the following is not considered

Q60: Lodging for a trip associated with medical

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents