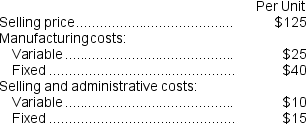

CoolAir Corporation manufactures portable window air conditioners.CoolAir has the capacity to manufacture and sell 80,000 air conditioners each year but is currently only manufacturing and selling 60,000.The following per unit numbers relate to annual operations at 60,000 units:  The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each.Variable selling and administrative costs on this special order will drop down to $2 per unit.This special order will not affect the 60,000 regular sales and it will not affect the total fixed costs.The annual financial advantage (disadvantage) for the company as a result of accepting this special order from the City of Clearwater should be:

The City of Clearwater would like to purchase 3,000 air conditioners from CoolAir but only if they can get them for $75 each.Variable selling and administrative costs on this special order will drop down to $2 per unit.This special order will not affect the 60,000 regular sales and it will not affect the total fixed costs.The annual financial advantage (disadvantage) for the company as a result of accepting this special order from the City of Clearwater should be:

A) ($21,000)

B) $24,000

C) $144,000

D) ($129,000)

Correct Answer:

Verified

Q41: Lusk Corporation produces and sells 10,000 units

Q58: Schickel Inc.regularly uses material B39U and currently

Q61: Rebelo Corporation is presently making part E07

Q64: Vanik Corporation currently has two divisions which

Q65: United Industries manufactures a number of products

Q67: The management of Furrow Corporation is considering

Q68: Part U16 is used by Mcvean Corporation

Q82: Fabri Corporation is considering eliminating a department

Q94: Kahn Corporation (a multi-product company) produces and

Q97: A study has been conducted to determine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents