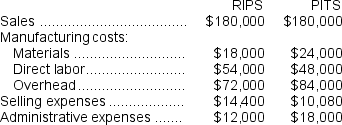

Omstadt Corporation produces and sells only two products that are referred to as RIPS and PITS.Production is "for order" only, and no finished goods inventories are maintained; work in process inventories are negligible.The following data relate to last month's operations:  $36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed.The balance of the overhead is variable.Selling expenses consist entirely of commissions paid as a percentage of sales.Direct labor is completely variable.Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

$36,000 of the manufacturing overhead assigned to RIPS and $72,000 of that assigned to PITS is fixed.The balance of the overhead is variable.Selling expenses consist entirely of commissions paid as a percentage of sales.Direct labor is completely variable.Administrative expenses are fixed and cannot be traced to the products but have been arbitrarily allocated to the products.

Required:

Prepare a segmented income statement, in total and for the two products.Use the contribution approach.

Correct Answer:

Verified

Q279: Borunda Corporation has provided the following data

Q280: Worrel Corporation manufactures a single product.The following

Q281: The Carlsbad Corporation produces and markets two

Q282: Koff Corporation has two divisions: Garden Division

Q283: Petteway Corporation has two divisions: Home

Q286: Clouthier Corporation has two divisions: Home Division

Q287: Zable Corporation has two divisions: Town Division

Q288: Spiess Corporation has two major business segments--Apparel

Q289: Therrell Corporation has two divisions: Bulb Division

Q373: Fausnaught Corporation has two major business segments--Retail

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents