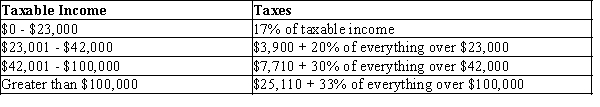

-Refer to Exhibit 11-4.If a person's taxable income is $20,000,how much does he pay in taxes?

A) $600

B) $34,000

C) $3,400

D) $3,000

Correct Answer:

Verified

Q117: If Smith believes the economy is self-regulating,then

Q118: The economy is in a recessionary gap

Q119: Suppose government spending rises by $120 billion.It

Q120: The answer is: "After a policy measure

Q121: If the economy is on the downward-sloping

Q123: Which four federal taxes make up the

Q124: According to the textbook (based upon 2014

Q125: Which of the following statements is true?

A)

Q126: What are the two types of discretionary

Q127: A "flat tax" is another term for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents