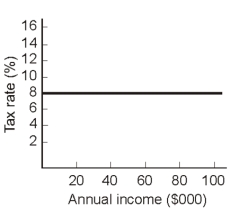

-The tax shown in the graph above is

A) nominally progressive and regressive in effect.

B) nominally progressive and progressive in effect.

C) nominally proportional and progressive in effect.

D) nominally proportional and regressive in effect.

Correct Answer:

Verified

Q78: In 2009 the highest federal personal income

Q79: In 2010,anyone with an income in excess

Q80: Statement I: Most poor people have an

Q81: Mr.Romney paid $300 in personal income tax.His

Q82: The marginal tax rate is calculated by

Q84: Which of the following statements about the

Q85: "Taxable income" is

A)total income less deductions and

Q86: In 2009,_ of Americans owed no federal

Q87: Statement I: We have faithfully followed Adam

Q88: Which of the following is the best

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents