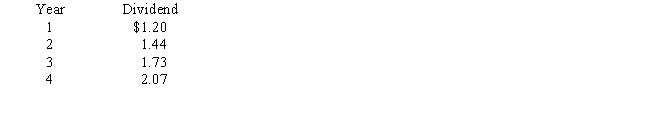

Presently,Stock A pays a dividend of $2.00 a share,and you expect the dividend to grow rapidly for the next four years at 20 percent.Thus the dividend payments will be

After this initial period of super-growth,the rate of increase in the dividend should decline to 8 percent.If you want to earn 12 percent on investments in common stock,what is the maximum you should pay for this stock?

After this initial period of super-growth,the rate of increase in the dividend should decline to 8 percent.If you want to earn 12 percent on investments in common stock,what is the maximum you should pay for this stock?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: If the ratio of price to book

Q29: Two stocks each pay a $1 dividend

Q30: If you purchase TrisCorp stock at $71

Q31: The risk-free rate of return is 8

Q32: Your broker recommends that you purchase XYZ

Q60: The weak form of the efficient market

Q62: Investors may use P/E ratios and price/sales

Q66: As an investor you have a required

Q68: You know the following concerning a common

Q73: Pre-emptive rights permit stockholders to

A)collect dividends before

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents