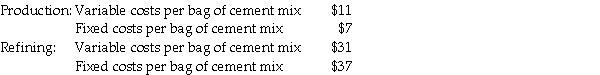

Gravel and Sand Corporation has two divisions,Refining and Production.The company's primary product is Quick-dry Cement Mix.Each division's costs are provided below:

The Refining Division has been operating at a capacity of 42,000 bags a day and usually purchases 25,750 from the Production Division and 16,250 bags of cement mix from other suppliers at $62 per bag.

Required

Based on the provided information,what is the transfer price per bag from the Production Division to the Refining Division,assuming the method used to place a value on each bag of cement mix is 190% of variable costs? Compute the transfer price per bag from the Production Division to the Refining Division,assuming the method used to place a value on each bag of cement mix is 115% of full costs.Assume 230 bags are transformed from the Production Division to the Refining Division for a transfer price of $20 per bag.The Refining Division sells the 230 bags at a price of $105 each to customers.What is the operating income of both divisions together?

A) $20.90;$20.70;$6,670

B) $21.90;$21.70;$6,675

C) $21.95;$21.75;$6,670

D) $22.05;$21.80;$6,675

E) $22.10;$21.85;$6,680

Correct Answer:

Verified

Q51: Scuba Tank Company manufactures only one type

Q52: Review the transfer-price methods listed below and

Q53: The managerial accountant at Mega Petroleum reported

Q54: Which of the following methods includes a

Q55: Which of the following exists when there

Q57: The most common form of hybrid price

Q58: How do managers reduce excessive focus of

Q59: What is the focus of managers in

Q60: Mega Petroleum has two divisions,each operating as

Q61: If markets are not perfectly competitive,selling prices

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents