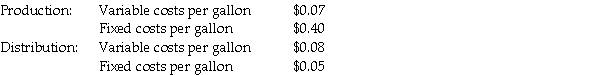

Vitamin D Dairy has two divisions,Distribution and Production.The company's primary product is milk.Each division's costs are provided below:

The Distribution Division has been operating at a capacity of 4,500,000 gallons a week and usually purchases 2,250,000 gallons from the Production Division and 2,250,000 gallons from other suppliers at $1.00 per gallon.

Required

What is the transfer price per gallon from the Production Division to the Distribution Division,assuming the method used to place a value on each gallon of milk is 170% of variable costs? Next,compute the transfer price per gallon from the Production Division to the Distribution Division,assuming the method used to place a value on each gallon of milk is 130% of full costs.

Assume 150,000 gallons are transferred from the Production Division to the Distribution Division for a transfer price of $0.85 per gallon.The Distribution Division sells the 150,000 gallons at a price of $1.20 each to customers.What is the operating income of both divisions together?

A) $0.10; $0.60; $85,000

B) $0.12; $0.61; $90,000

C) $0.14; $0.62; $92,000

D) $0.16; $0.64; $94,000

E) $0.18; $0.66; $96,000

Correct Answer:

Verified

Q37: Which of the following is not true

Q38: How can managers use information technology to

Q39: _ ease the subunit managers' information-processing and

Q40: Decentralization speeds decision making,creating a competitive advantage

Q41: The cost used in cost-based transfer prices

Q43: Which of the cost scenarios listed below

Q44: Which of the following is not an

Q45: Temporary drops in market prices below historical

Q46: Choose the appropriate transfer-price method ideal to

Q47: Under imperfect competition,the transfer price should be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents