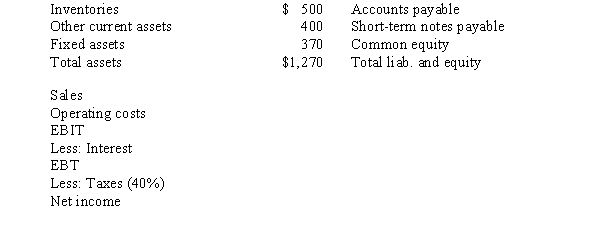

Savelots Stores' current financial statements are shown below:  A recently released report indicates that Savelots' current ratio of 1.9 is in line with the industry average.However,its accounts payable,which have no interest cost and which are due entirely to purchases of inventories,amount to only 20% of inventory versus an industry average of 60%.Suppose Savelots took actions to increase its accounts payable to inventories ratio to the 60% industry average,but it (1) kept all of its assets at their present levels (that is,the asset side of the balance sheet remains constant) and (2) also held its current ratio constant at 1.9.Assume that Savelots' tax rate is 40%,that its cost of short-term debt is 10%,and that the change in payments will not affect operations.In addition,common equity would not change.With the changes,what would be Savelots' new ROE?

A recently released report indicates that Savelots' current ratio of 1.9 is in line with the industry average.However,its accounts payable,which have no interest cost and which are due entirely to purchases of inventories,amount to only 20% of inventory versus an industry average of 60%.Suppose Savelots took actions to increase its accounts payable to inventories ratio to the 60% industry average,but it (1) kept all of its assets at their present levels (that is,the asset side of the balance sheet remains constant) and (2) also held its current ratio constant at 1.9.Assume that Savelots' tax rate is 40%,that its cost of short-term debt is 10%,and that the change in payments will not affect operations.In addition,common equity would not change.With the changes,what would be Savelots' new ROE?

A) 10.5%

B) 7.8%

C) 9.0%

D) 13.2%

E) 12.0%

Correct Answer:

Verified

Q22: Pepsi Corporation's current ratio is 0.5, while

Q41: Retailers Inc.and Computer Corp.each have assets of

Q51: On its December 31st balance sheet,LCG Company

Q57: Given the following information,calculate the market price

Q58: Harvey Supplies Inc.has a current ratio of

Q69: A firm has a profit margin of

Q77: Assume Meyer Corporation is 100 percent equity

Q80: Collins Company had the following partial balance

Q80: All other things constant, an increase in

Q82: Lombardi Trucking Company has the following data:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents