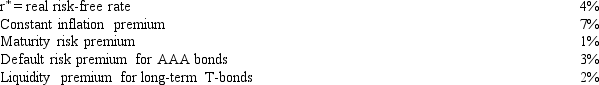

You are given the following data:  Assume that a highly liquid market does not exist for long-term T-bonds,and the expected rate of inflation is a constant.Given these conditions,the nominal risk-free rate for T-bills is __________,and the rate on long-term Treasury bonds is __________.

Assume that a highly liquid market does not exist for long-term T-bonds,and the expected rate of inflation is a constant.Given these conditions,the nominal risk-free rate for T-bills is __________,and the rate on long-term Treasury bonds is __________.

A) 4%; 14%

B) 4%; 15%

C) 11%; 14%

D) 11%; 15%

E) 11%; 17%

Correct Answer:

Verified

Q3: Assume that the current yield curve is

Q9: Assume that expected rates of inflation over

Q12: Interest rates on 1-year,2-year,and 3-year Treasury bills

Q14: Assume that the expectations theory holds,and that

Q19: Treasury securities that mature in 6 years

Q20: Assume that r* = 1.0%;the maturity risk

Q33: The normal yield curve is upward sloping

Q35: Which of the following is not one

Q37: Allen Corporation can (1)build a new plant

Q43: If the Federal Reserve sells $50 billion

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents