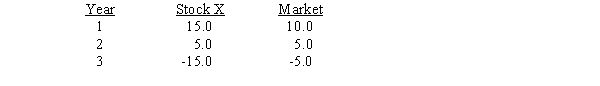

Stock X and the "market" had the following returns during the last three years,and the same relative volatility is expected to exist in the future:  The riskless rate is rRF = 8%,and the expected return on the market is 12 percent.If equilibrium exists,what is the expected return on Stock X?

The riskless rate is rRF = 8%,and the expected return on the market is 12 percent.If equilibrium exists,what is the expected return on Stock X?

A) -4%

B) 8%

C) 12%

D) 14%

E) 16%

Correct Answer:

Verified

Q42: Which of the following statements is most

Q44: Steve Brickson currently has an investment portfolio

Q45: Given the following information,compute the standard deviation

Q47: Calculate the standard deviation of the expected

Q48: Based on the information given below,which of

Q49: Assume the risk-free rate of return (rRF)

Q50: Stock X has ? = 4.0,which means

Q51: Assume you are considering combining two investments

Q53: is a measure of total risk, whereas

Q60: If the risk-free rate is 7 percent,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents