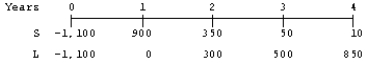

A company is analyzing two mutually exclusive projects,S and L,whose cash flows are shown below:  The company's required rate of return is 12 percent.What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR.)

The company's required rate of return is 12 percent.What is the IRR of the better project? (Hint: Note that the better project may or may not be the one with the higher IRR.)

A) 13.09%

B) 12.00%

C) 17.46%

D) 13.88%

E) 12.53%

Correct Answer:

Verified

Q81: Houston Inc.is considering a project which involves

Q83: Given the following net cash flows,determine the

Q84: O'Donnell Inc.has a required rate of return

Q87: International Transport Company is considering building a

Q87: Your company is considering two mutually exclusive

Q88: Los Angeles Lumber Company (LALC) is considering

Q90: Capitol City Transfer Company is considering building

Q91: Your company is choosing between following non-repeatable,equally

Q95: After getting her degree in marketing and

Q99: An investment project has an initial cost,and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents