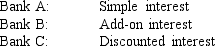

You go to three different banks to borrow $10,000 for one year.Each says it will lend you the money at 10 percent,but their terms differ as follows:  Banks A and C require a single payment at the end of the year.Bank B requires 12 equal monthly payments beginning at the end of the first month.What is the difference between the highest and lowest effective annual rate in this case?

Banks A and C require a single payment at the end of the year.Bank B requires 12 equal monthly payments beginning at the end of the first month.What is the difference between the highest and lowest effective annual rate in this case?

A) 13.0%

B) 9.5%

C) 9.0%

D) 8.5%

E) 8.0%

Correct Answer:

Verified

Q24: Viking Farms harvests crops in roughly 90-day

Q26: Judy's Fashions, Inc. purchases supplies from a

Q44: Quickbow Company currently uses maximum trade credit

Q49: Wicker Corporation is determining whether to support

Q57: Your firm buys on credit terms of

Q63: The Lasser Company needs to finance an

Q94: C+ Notes' business is booming, and it

Q96: Assume that Sunshine Products Inc.has an agreement

Q100: Every 10 days you receive $5,000 worth

Q104: Inland Oil arranged a $10,000,000 revolving credit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents