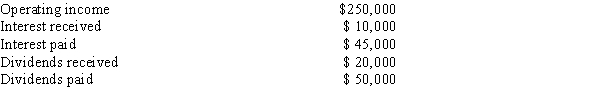

Your corporation has the following cash flows:

If the applicable income tax rate is 40% (federal and state combined) ,and if 70% of dividends received are exempt from taxes,what is the corporation's tax liability?

A) $ 83,980

B) $ 88,400

C) $ 92,820

D) $ 97,461

E) $102,334

Correct Answer:

Verified

Q79: Rao Construction recently reported $20.50 million of

Q80: Which of the following would be most

Q81: Wu Systems has the following balance sheet.How

Q82: C.F.Lee Inc.has the following income statement.How much

Q83: Your corporation has a marginal tax rate

Q85: Hayes Corporation has $300 million of common

Q86: Brown Office Supplies recently reported $15,500 of

Q87: Last year Almazan Software reported $10.50 million

Q88: Shrives Publishing recently reported $10,750 of sales,$5,500

Q89: Hartzell Inc.had the following data for 2013,in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents