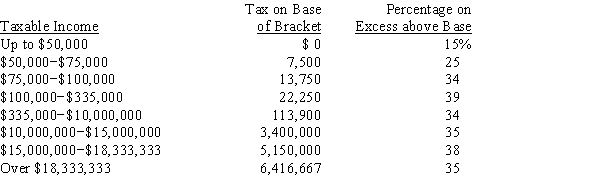

Griffey Communications recently realized $125,000 in operating income.The company had interest income of $25,000 and realized $70,000 in dividend income.The company's interest expense was $40,000. Using the corporate tax schedule above,what is Griffey's tax liability?

A) $29,442

B) $30,992

C) $32,623

D) $34,340

E) $36,057

Correct Answer:

Verified

Q118: A company with a 15% tax rate

Q119: Appalachian Airlines began operating in 2010.The company

Q120: Last year,Stewart-Stern Inc.reported $11,250 of sales,$4,500 of

Q121: Uniontown Books began operating in 2010.The company

Q122: Moose Industries faces the following tax schedule:

Last

Q124: Salinger Software was founded in 2011.The company

Q125: Last year,Martyn Company had $500,000 in taxable

Q126: Collins Co.began operations in 2011.The company lost

Q127: Mays Industries was established in 2009.Since its

Q128: Corporations face the following tax schedule:

Company Z

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents