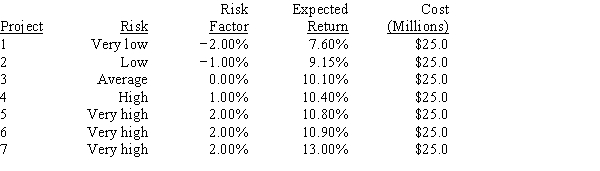

Vang Enterprises,which is debt-free and finances only with equity from retained earnings,is considering 7 equal-sized capital budgeting projects.Its CFO hired you to assist in deciding whether none,some,or all of the projects should be accepted.You have the following information: rRF = 4.50%; RPM = 5.50%; and b = 0.92.The company adds or subtracts a specified percentage to the corporate WACC when it evaluates projects that have above- or below-average risk.Data on the 7 projects are shown below.If these are the only projects under consideration,how large should the capital budget be?

A) $100

B) $ 75

C) $ 50

D) $ 25

E) $ 0

Correct Answer:

Verified

Q84: You were hired as a consultant to

Q85: Exhibit 10.1

Assume that you have been hired

Q86: Sapp Trucking's balance sheet shows a total

Q87: Daves Inc.recently hired you as a consultant

Q88: Assume that you are on the financial

Q89: Exhibit 10.1

Assume that you have been hired

Q90: S.Bouchard and Company hired you as a

Q91: Eakins Inc.'s common stock currently sells for

Q92: Bolster Foods' (BF)balance sheet shows a total

Q94: Exhibit 10.1

Assume that you have been hired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents