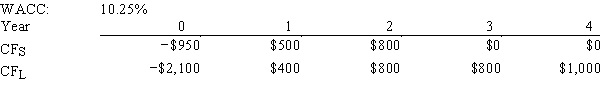

Yonan Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the shorter payback,some value may be forgone.How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost.

A) $24.14

B) $26.82

C) $29.80

D) $33.11

E) $36.42

Correct Answer:

Verified

Q97: Last month,Lloyd's Systems analyzed the project whose

Q98: Resnick Inc.is considering a project that has

Q99: Simkins Renovations Inc.is considering a project that

Q100: Jazz World Inc.is considering a project that

Q101: Sexton Inc.is considering Projects S and L,whose

Q103: Tesar Chemicals is considering Projects S and

Q104: A firm is considering Projects S and

Q105: Nast Inc.is considering Projects S and L,whose

Q106: Noe Drilling Inc.is considering Projects S and

Q107: Kosovski Company is considering Projects S and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents