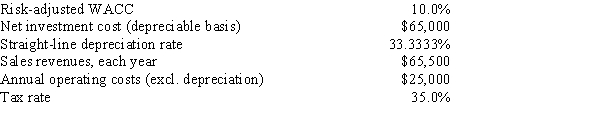

Temple Corp.is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life,would be depreciated by the straight-line method over its 3-year life,and would have a zero salvage value.No change in net operating working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV?

A) $15,740

B) $16,569

C) $17,441

D) $18,359

E) $19,325

Correct Answer:

Verified

Q71: Carlyle Inc.is considering two mutually exclusive projects.Both

Q72: Your company,RMU Inc.,is considering a new project

Q73: Poulsen Industries is analyzing an average-risk project,and

Q74: Wilson Co.is considering two mutually exclusive projects.Both

Q75: Clemson Software is considering a new project

Q77: Desai Industries is analyzing an average-risk project,and

Q78: You work for Whittenerg Inc.,which is considering

Q79: TexMex Food Company is considering a new

Q80: Thomson Media is considering some new equipment

Q81: Florida Car Wash is considering a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents