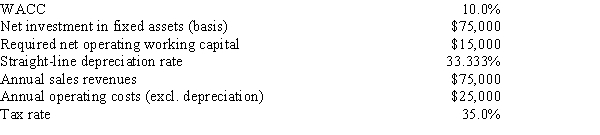

Foley Systems is considering a new investment whose data are shown below.The equipment would be depreciated on a straight-line basis over the project's 3-year life,would have a zero salvage value,and would require additional net operating working capital that would be recovered at the end of the project's life.Revenues and other operating costs are expected to be constant over the project's life.What is the project's NPV? (Hint: Cash flows from operations are constant in Years 1 to 3.)

A) $23,852

B) $25,045

C) $26,297

D) $27,612

E) $28,993

Correct Answer:

Verified

Q49: Which of the following rules is CORRECT

Q58: When evaluating a new project,firms should include

Q61: Your company,CSUS Inc.,is considering a new project

Q62: Liberty Services is now at the end

Q63: As a member of UA Corporation's financial

Q65: As assistant to the CFO of Boulder

Q66: Atlas Corp.is considering two mutually exclusive projects.Both

Q67: Mulroney Corp.is considering two mutually exclusive projects.Both

Q68: Sub-Prime Loan Company is thinking of opening

Q69: Marshall-Miller & Company is considering the purchase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents