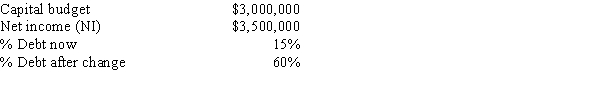

Clark Farms Inc.has the following data,and it follows the residual dividend model.Currently,it finances with 15% debt.Some Clark family members would like for the dividends to be increased.If Clark increased its debt ratio,which the firm's treasurer thinks is feasible,by how much could the dividend be increased,holding other things constant?

A) $1,093,500

B) $1,215,000

C) $1,350,000

D) $1,485,000

E) $1,633,500

Correct Answer:

Verified

Q41: Which of the following actions will best

Q58: Dentaltech Inc.projects the following data for the

Q59: Becker Financial recently declared a 2-for-1 stock

Q61: LA Moving Company has the following data,dollars

Q62: Purcell Farms Inc.has the following data,and it

Q64: Grullon Co.is considering a 7-for-3 stock split.The

Q65: NY Fashions has the following data.If it

Q66: New Orleans Builders Inc.has the following data.If

Q67: Ross-Jordan Financial has suffered losses in recent

Q68: Whitman Antique Cars Inc.has the following data,and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents