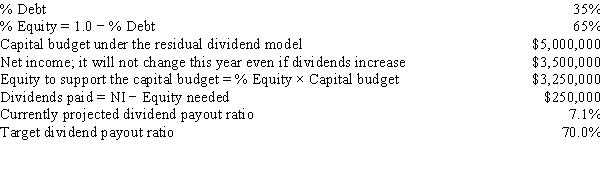

Walter Industries is a family owned concern.It has been using the residual dividend model,but family members who hold a majority of the stock want more cash dividends,even if that means a slower future growth rate.Neither the net income nor the capital structure will change during the coming year as a result of a dividend policy change to the indicated target payout ratio.By how much would the capital budget have to be cut to enable the firm to achieve the new target dividend payout ratio?

A) −$2,741,538

B) −$3,046,154

C) −$3,384,615

D) −$3,723,077

E) −$4,095,385

Correct Answer:

Verified

Q65: NY Fashions has the following data.If it

Q66: New Orleans Builders Inc.has the following data.If

Q67: Ross-Jordan Financial has suffered losses in recent

Q68: Whitman Antique Cars Inc.has the following data,and

Q69: Del Grasso Fruit Company has more positive

Q70: Whited Products recently completed a 4-for-1 stock

Q72: Chicago Brewing has the following data,dollars in

Q73: Sheehan Corp.is forecasting an EPS of $3.00

Q74: Pavlin Corp.'s projected capital budget is $2,000,000,its

Q75: Keys Financial has done extremely well in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents