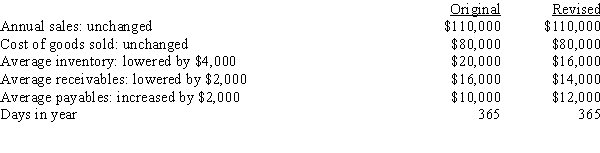

Zervos Inc.had the following data for last year (in millions) .The new CFO believes (1) that an improved inventory management system could lower the average inventory by $4,000,(2) that improvements in the credit department could reduce receivables by $2,000,and (3) that the purchasing department could negotiate better credit terms and thereby increase accounts payable by $2,000.Furthermore,she thinks that these changes would not affect either sales or the costs of goods sold.If these changes were made,by how many days would the cash conversion cycle be lowered?

A) 34.0 days

B) 37.4 days

C) 41.2 days

D) 45.3 days

E) 49.8 days

Correct Answer:

Verified

Q112: Buskirk Construction buys on terms of 2/15,net

Q113: Edison Inc.has annual sales of $36,500,000,or $100,000

Q114: Nogueiras Corp's budgeted monthly sales are $5,000,and

Q115: Van Den Borsh Corp.has annual sales of

Q116: A firm buys on terms of 2/8,net

Q118: Weiss Inc.arranged a $9,000,000 revolving credit agreement

Q119: Affleck Inc.'s business is booming,and it needs

Q120: Margetis Inc.carries an average inventory of $750,000.Its

Q121: Gonzales Company currently uses maximum trade credit

Q122: Exhibit 16.1

Zorn Corporation is deciding whether to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents