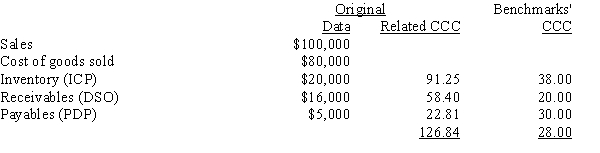

Soenen Inc.had the following data for last year (in millions) .The new CFO believes that the company could improve its working capital management sufficiently to bring its net working capital and cash conversion cycle up to the benchmark companies' level without affecting either sales or the costs of goods sold.Soenen finances its net working capital with a bank loan at an 8% annual interest rate,and it uses a 365-day year.If these changes had been made,by how much would the firm's pre-tax income have increased?

A) $1,901

B) $2,092

C) $2,301

D) $2,531

E) $2,784

Correct Answer:

Verified

Q105: Whitmer Inc.sells to customers all over the

Q106: Roton Inc.purchases merchandise on terms of 2/15,net

Q107: Your company has been offered credit terms

Q108: Ingram Office Supplies,Inc.,buys on terms of 2/15,net

Q109: Aggarwal Inc.buys on terms of 2/10,net 30,and

Q111: Bumpas Enterprises purchases $4,562,500 in goods per

Q112: Buskirk Construction buys on terms of 2/15,net

Q113: Edison Inc.has annual sales of $36,500,000,or $100,000

Q114: Nogueiras Corp's budgeted monthly sales are $5,000,and

Q115: Van Den Borsh Corp.has annual sales of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents