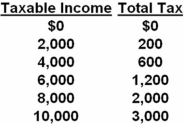

The following data represent a personal income tax schedule.  Refer to the above table.If your taxable income is $8000,your average tax rate is:

Refer to the above table.If your taxable income is $8000,your average tax rate is:

A) 25 percent and the marginal rate on additional income is also 25 percent.

B) 25 percent and the marginal rate on additional income is 40 percent.

C) 25 percent and the marginal rate on additional income cannot be determined from the information given.

D) 20 percent and the marginal rate on additional income is 30 percent.

At $8000 of taxable income your average tax rate is 25 percent (i.e. ,$2000 tax paid/$8000 income) .

Correct Answer:

Verified

Q8: The largest source of tax revenue for

Q13: The three most important sources of federal

Q16: The tax rates embodied in the federal

Q18: The largest category of federal spending is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents