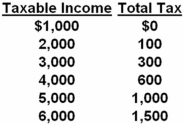

The tax represented above is:

The tax represented above is:

A) optimal.

B) proportional.

C) regressive.

D) progressive.

Correct Answer:

Verified

Q28: Taxable income is

A) total income less deductions

Q30: One difference between sales and excise taxes

Q36: With respect to local finance,

A) death and

Q37: Taxes on commodities or on purchases are

Q40: The following data represent a personal income

Q43: In 2008,U.S.governments (local,state,and federal)employed approximately how many

Q44: Indy currently earns $50,000 in taxable income

Q46: Approximately what percentage of local government expenditures

Q47: Federal employment in the United States is

Q50: The benefits-received principle of taxation is most

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents