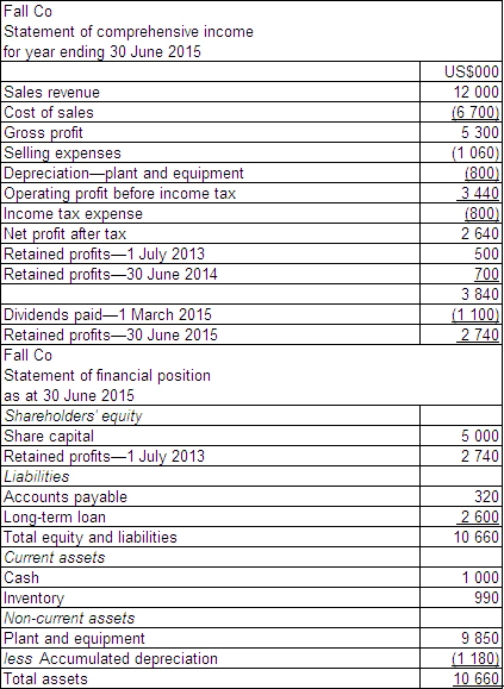

On 1 July 2013 Land Ltd acquired all of the issued shares of Fall Co,a company based in the US.The financial statements for Fall Co for the year ended 30 June 2015 are provided below.Exchange rate information is:  Additional information:

Additional information:

All revenues and expenses were earned or incurred evenly throughout the year.

All plant and equipment was purchased using a long-term loan when the exchange rate was A$1.00 = US$0.54.

Inventory was purchased evenly over the period,with the inventory on hand at the end of the period purchased over the quarter ending on 30 June,and accounts payable were accrued evenly over the period.

What are the translated amounts for operating profit,retained profit at 30 June 2015,total equity and liabilities and the gain or loss on foreign currency translation for Fall Co (rounded to the nearest A$) ?

A)

B)

C)

D)

Correct Answer:

Verified

Q35: Under the translation method required by AASB

Q36: In the process of consolidating the translated

Q37: In the process of consolidating the translated

Q38: AASB 121 specifies that post-acquisition movements in

Q39: If the assets of a foreign operation

Q41: Explain at what exchange rate income and

Q42: Distinguish monetary items from non-monetary items.Provide two

Q43: As prescribed in AASB 121,when re-measuring financial

Q44: Contrast how statement of financial position items

Q45: Lennon Ltd has two foreign operations

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents