Green Ltd purchased 90 per cent of the issued capital and in the process gained control over Maroon Ltd on 1 July 2015.The fair value of the net assets of Maroon Ltd at purchase was represented by:

Green Ltd paid cash consideration of $3 700 000 for Maroon Ltd.During the period ended 30 June 2017,Maroon Ltd paid management fees of $100 000 to Green Ltd and Maroon had an operating profit of $405 000.Maroon Ltd declared a dividend of $98 000 during the period.Green purchased inventory from Maroon during the period ended 30 June 2017 for $100 000.The inventory cost Maroon Ltd $85 000 and at the end of the period Green had 35 per cent of that inventory still on hand.Maroon's opening retained earnings for the period ended 30 June 2017 was $810 000.Goodwill has been determined to have been impaired by $13 600.Companies in the group use perpetual inventory systems and accrue dividends when they are declared by subsidiaries.There were no other inter-company transactions.Ignore tax implications.

For the period ended 30 June 2017,what consolidation journal entries are required and what is the outside equity interest?

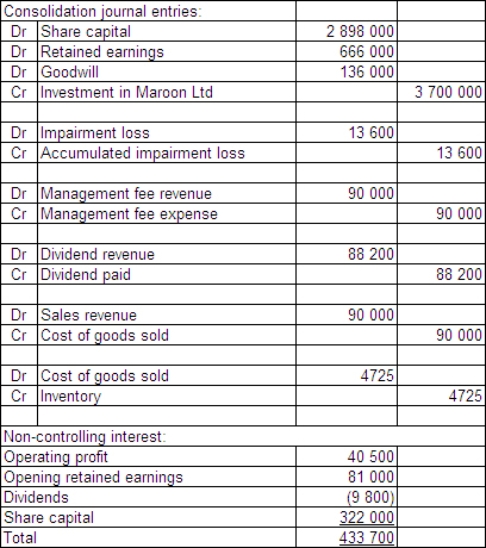

A)

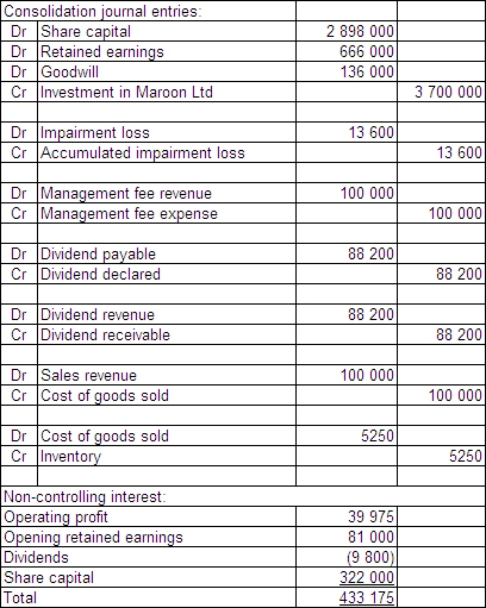

B)

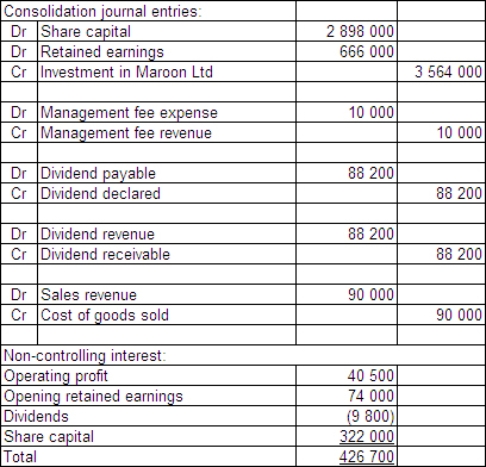

C)

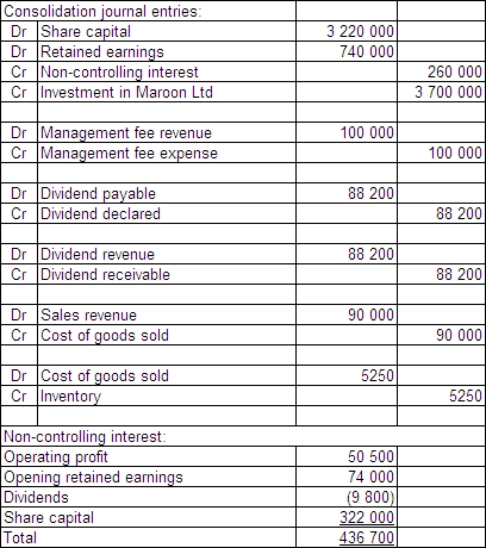

D)

Correct Answer:

Verified

Q21: Groucho Ltd purchased 60 per cent

Q22: There is no adjustment for things such

Q23: Which of the following statements is incorrect

Q24: In adjusting for intragroup transactions prior to

Q25: On 1 July 2012,Han Solo Ltd

Q27: After eliminating the dividend payable to the

Q28: Which of the following is not one

Q29: As prescribed in AASB 10,which of the

Q30: The disclosure of non-controlling interests in the

Q31: Which of the following statements is incorrect

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents