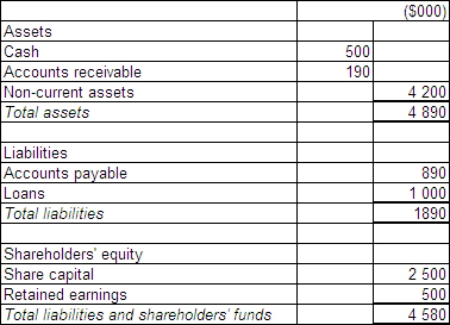

Candle Ltd acquires all the issued capital of Wick Ltd for a cash payment of $4 500 000 on 30 June 2014.The statement of financial position of Wick Ltd at purchase date is:  The fair value of the net assets of Wick Ltd as at 30 June 2014 is $3 800 000.What is the consolidation entry to eliminate the investment in Wick Ltd?

The fair value of the net assets of Wick Ltd as at 30 June 2014 is $3 800 000.What is the consolidation entry to eliminate the investment in Wick Ltd?

A)

B)

C)

D)

Correct Answer:

Verified

Q45: Sigmund Ltd acquires all the issued capital

Q46: 'Control' exists when the parent owns less

Q47: In a situation where the net assets

Q48: Non-controlling interests are defined is AASB 10

Q49: Arthur Ltd acquires all the issued capital

Q51: Where the controlled entity's non-current assets

Q52: In what situation does an excess on

Q53: Gingimup Ltd purchased all the equity

Q54: Gouda Ltd acquires all the issued

Q55: Banderas Ltd acquires all the issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents