On 1 April 2013,Ulladulla Mining Ltd assessed that its Mollymook area of interest contained economically recoverable reserves of 50 000 ounces of gold.On the same day the entity installed the following assets: The above assets were ready for use on 1 July 2013.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2014 the entity had extracted 5000 ounces of gold.

What is the journal entry to recognise amortisation and depreciation expense of above capitalised developments costs?

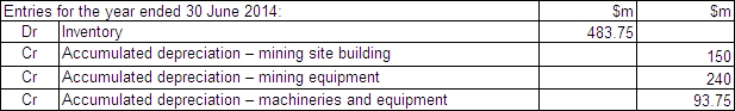

A)

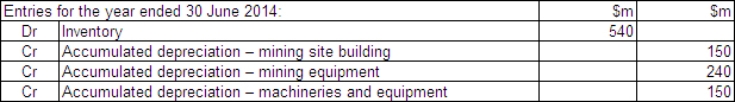

B)

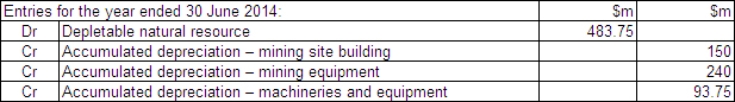

C)

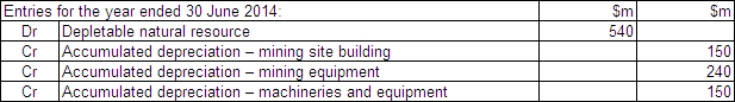

D)

Correct Answer:

Verified

Q52: On 1 April 2013 Ulladulla Mining

Q53: Which of the following statements is correct?

A)

Q54: If an area of interest is abandoned,which

Q55: Which of the following statements is not

Q56: On 1 July 2012 Brumbles Ltd

Q58: Which of the following are within the

Q59: Berrill Ltd is a mining firm

Q60: Research conducted in Australia suggests that only

Q61: Inventories are covered by which of the

Q62: Which of the following expenditures is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents