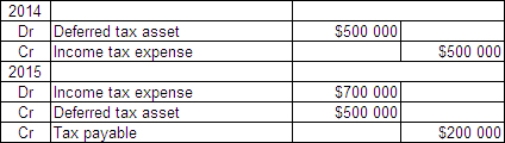

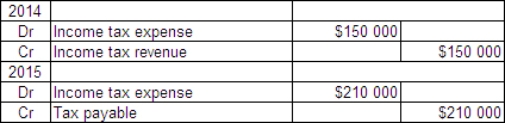

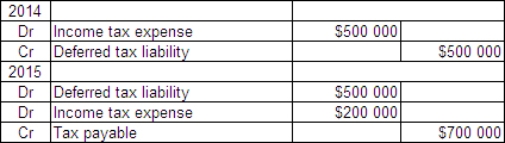

Casper Ltd incurred a loss of $500 000 for tax purposes in 2014.This was due to one-off circumstances and it is expected that Casper will make profits again in 2015 and subsequent years.There are no temporary differences in either year.In 2015 Casper makes a profit of $700 000.The tax rate is 30%.What are the journal entries for 2014 and 2015?

A)

B)

C)

D)

Correct Answer:

Verified

Q36: The AASB 112 approach has been adopted

Q37: A change in tax rates does not

Q38: Under the approach of AASB 112 to

Q39: Some items are typically not allowable tax

Q40: The amount of tax assessed by the

Q42: Some items are typically not allowable tax

Q43: The carrying amount of a deferred tax

Q44: Digitor Industries Ltd accrues long-service leave

Q45: Mighty Motors Ltd offers a warranty

Q46: The carrying amount of deferred tax assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents