Wigan Ltd grants 100 options to each of its 80 employees on 1 July 2009.The fair value of each option at grant date is $20.The vesting conditions allow shares to vest if the following performance targets are achieved:

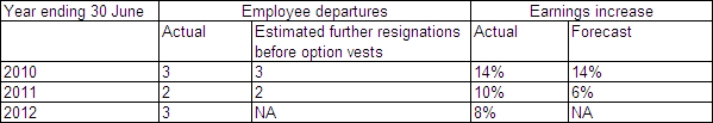

The following information is available:

In accordance with AASB 2,how much employee benefits expense related to the share option issue should Wigan Ltd recognise for the year ended 30 June 2010?

A) $48 000

B) $49 333

C) $72 000

D) $74 000

Correct Answer:

Verified

Q54: Southport Ltd grants 100 share appreciation

Q55: Southport Ltd grants 100 share appreciation

Q56: Southport Ltd grants 100 share appreciation

Q57: Liverpool Ltd grants 100 options to

Q58: Liverpool limited grants 100 options to

Q60: On 1 July 2009,Windermere Ltd grants

Q61: Winton Ltd grants 100 options to

Q62: Discuss the accounting treatment required in AASB

Q63: Are there parties that would benefit from

Q64: Penneshaw Ltd grants 100 options to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents