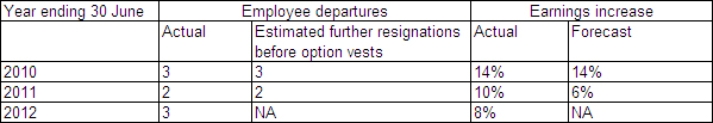

Wigan Ltd grants 100 options to each of its 80 employees on 1 July 2009.The fair value of each option at grant date is $20.The vesting conditions allow shares to vest if the following performance targets are achieved:

The following information is available:

What action must Wigan Ltd take that is in compliance with AASB 2,if the option does not vest on 30 June 2012?

A) No action is necessary.

B) It must modify the terms and conditions of the option to allow the employees to benefit from the share-based payment transaction in future.

C) The equity account arising from the share-based payment transaction shall be reversed and credited to revenue.

D) The equity account arising from the share-based payment transaction shall be reversed and credited to liability.

Correct Answer:

Verified

Q36: Market prices for share options granted to

Q37: Which of the following statements is incorrect

Q38: On 1 July 2012 Lancaster Ltd grants

Q39: In a share-based payment transaction like an

Q40: On 1 July 2012 Lancashire Ltd grants

Q42: Southport Ltd grants 100 share appreciation

Q43: On 1 July 2009,Windermere Ltd grants

Q44: Liverpool Ltd grants 100 options to

Q45: Southport Ltd grants 100 share appreciation

Q46: On 1 July 2012 Chester Ltd granted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents