On 1 July 2013 Bigwell Ltd sells a machine to Archer Ltd in exchange for a promissory note that requires Archer Ltd to make five payments of $8000,the first to be made on 30 June 2014.The machine cost Bigwell Ltd $20 000 to manufacture.Bigwell Ltd would normally sell this type of machine for $30 326 for cash or short-term credit.The implicit interest rate in the agreement is 10%.What are the appropriate journal entries to record the sale agreement and the first two instalments using the gross method?

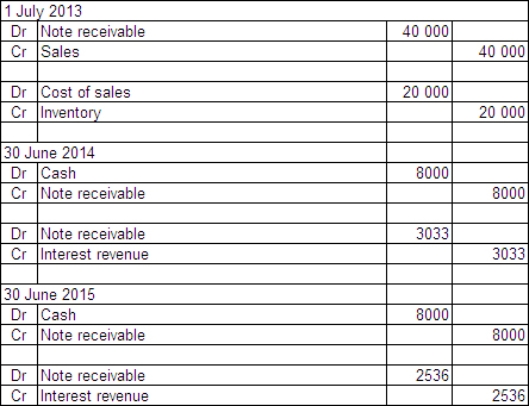

A)

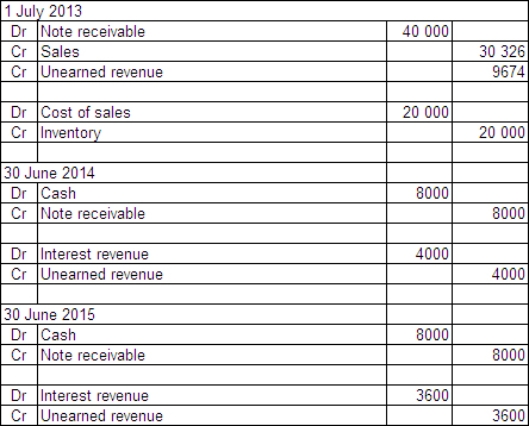

B)

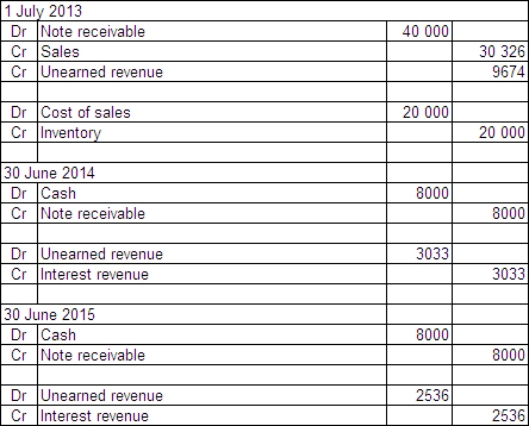

C)

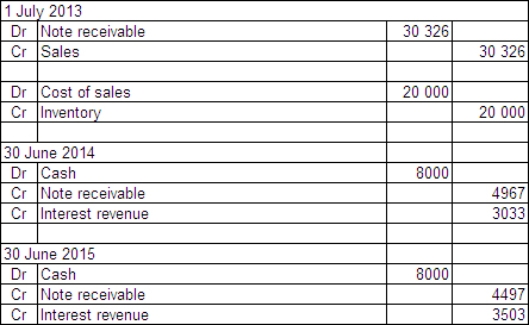

D)

Correct Answer:

Verified

Q20: Construction costs plus gross profit earned to

Q21: Under the AASB (IASB)Conceptual Framework income is

Q22: Interest revenue is derived from borrowing resources

Q23: In the situation that a debtor becomes

Q24: Revenues may be generated by:

A) holding and

Q26: When goods are sold on extended credit

Q27: On 1 July 2013 Bryson Ltd sells

Q28: The general rule under modified historical-cost accounting

Q29: When the collectability of an amount that

Q30: The following is a diagram of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents