Two companies enter into loan agreements on 1 March 2013.On that date they also enter into an agreement to swap the loans.The details for each company and loan are: Exchange rates:

The balance date for both companies is 30 June 2013.What are the accounting entries in the books of Boris Ltd on 1 March and 30 June 2013?

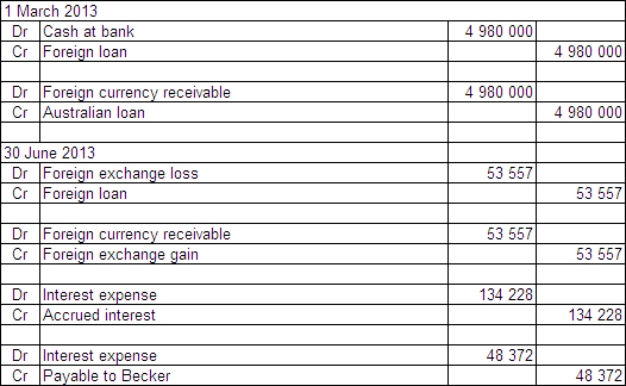

A)

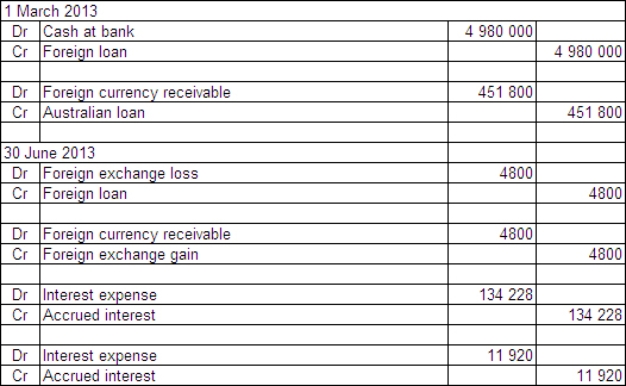

B)

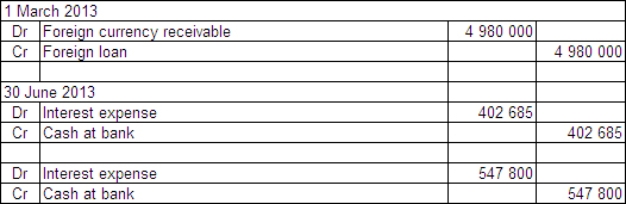

C)

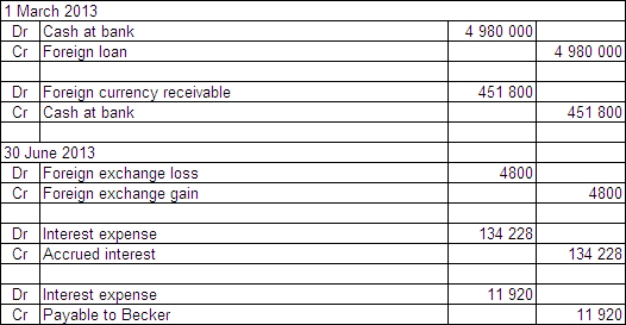

D)

Correct Answer:

Verified

Q40: Which of the following are examples of

Q41: Basket Ltd acquired a parcel of 50

Q42: Which of the following statements is true

Q43: What is the appropriate accounting treatment for

Q44: Under the requirements of the AASB Framework

Q46: Layton Enterprises and Hewitt Ltd agree

Q47: Sampras Ltd issued $20 million of convertible

Q48: The characteristics of a swap agreement may

Q49: Penitent Ltd acquired a parcel of 10

Q50: Which of the following statements about a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents