Two companies enter into loan agreements on 1 July 2012.On that date they also enter into an agreement to swap the loans.The details for each company and loan are: Exchange rates:

The balance date for both companies is 30 June 2013.What are the accounting entries in the books of Agassi Ltd on 1 July 2002 and 30 June 2013?

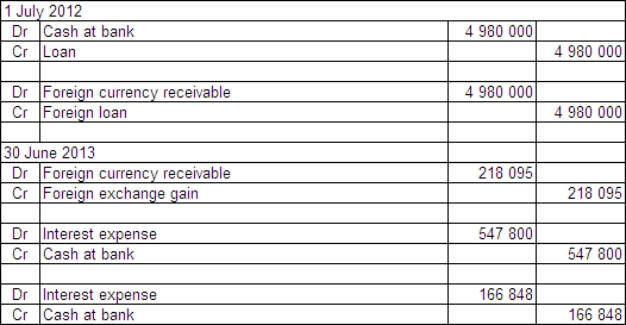

A)

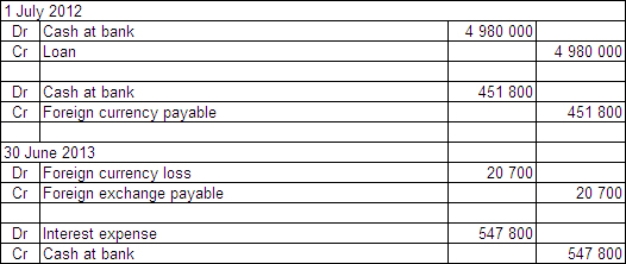

B)

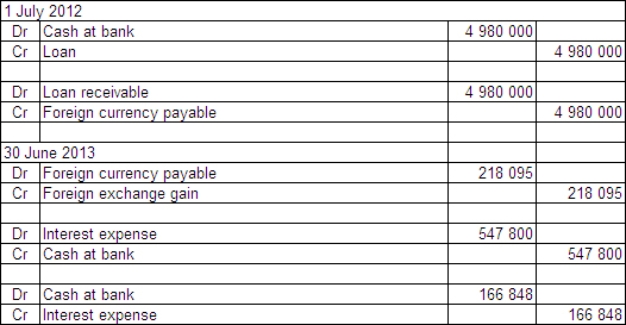

C)

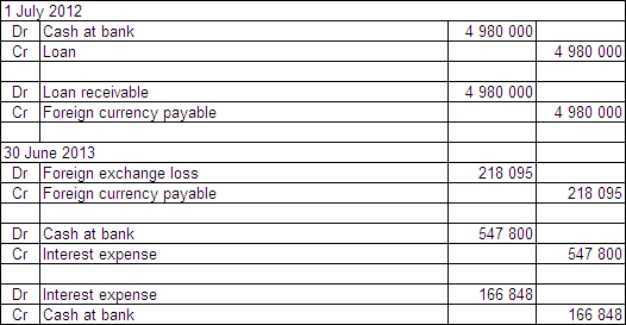

D)

Correct Answer:

Verified

Q51: Racquet Ltd issued $20 million of

Q52: Prepayments are:

A) not financial instruments because they

Q53: AASB 139 stipulates how financial instruments are

Q54: An attribute of an equity instrument is

Q55: A convertible note may be accurately described

Q57: Financial assets do not include:

A) cash.

B) notes

Q58: The market price of an option is

Q59: For a financial instrument to be classified

Q60: A preference share is a financial liability:

A)

Q61: In disclosing information about how a financial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents