Kerry Gill works for Kentucky Enterprises for an annual salary of $60 000.Kerry is entitled to 4 weeks' annual leave per year with a leave loading of 17.5%.What entry each week,additional to the one recording wages expense and PAYG tax deduction,would be required to accrue Kerry's entitlement to annual leave? When Kerry takes his 4 weeks' annual leave,what entry would be made to record this (only) ?

The tax is calculated at 30%.(Assume that there are 52 weeks in a year and round to the nearest dollar.)

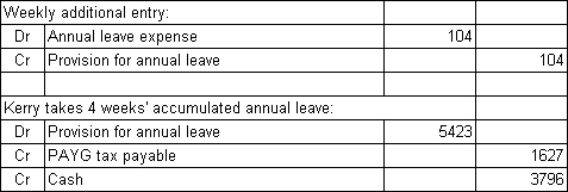

A)

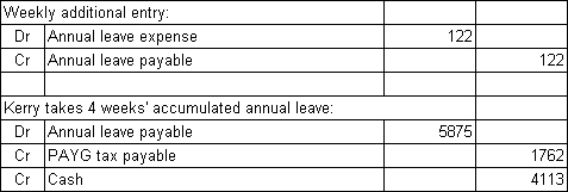

B)

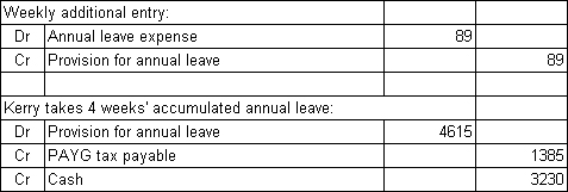

C)

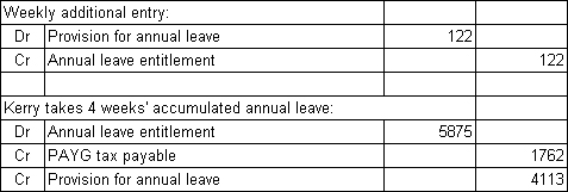

D)

Correct Answer:

Verified

Q17: Long-service leave that is payable beyond 12

Q18: If there is no deep market for

Q19: Non-vesting sick leave that has accumulated will

Q20: Employees generally receive superannuation entitlements as part

Q21: Short-term employee benefits are defined in AASB

Q23: For a defined benefit plan,if the fair

Q24: The appropriate accounting treatment for accumulating non-vesting

Q25: A defined contribution superannuation plan is one

Q26: Minor Ltd has a weekly payroll of

Q27: Which of the following is not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents