Cobalt Ltd owns an item of machinery that has a cost of $700 000 and accumulated depreciation of $200 000 as at 1 July 2013.On that date the machine is sold to Blue Ltd for $533 493,and then leased back over 8 years (the remaining life of the machine) .The lease is non-cancellable.The lease payments are $100 000 per annum,payable in arrears on 30 June each year.The interest rate implicit in the lease is 10% and the economic benefits of the asset are expected to be realised evenly over its life.What are the entries to record the transactions in Cobalt's books on 1 July 2013 and 30 June 2014 (rounded to the nearest dollar) ?

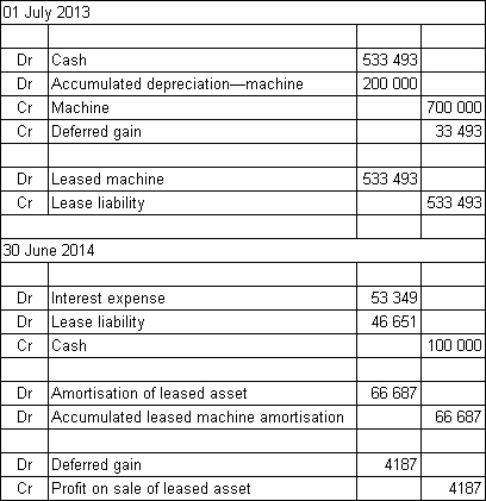

A)

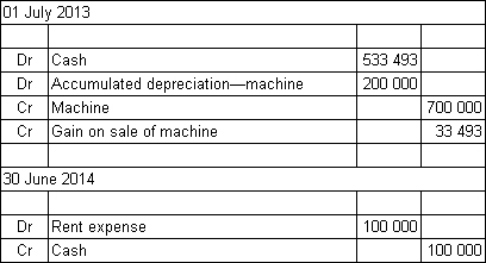

B)

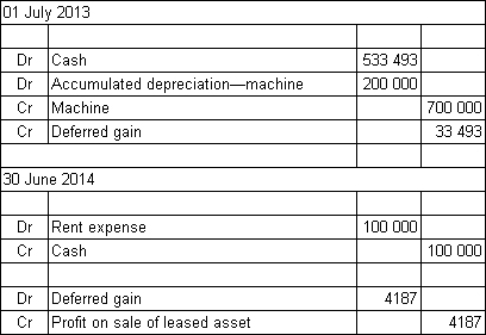

C)

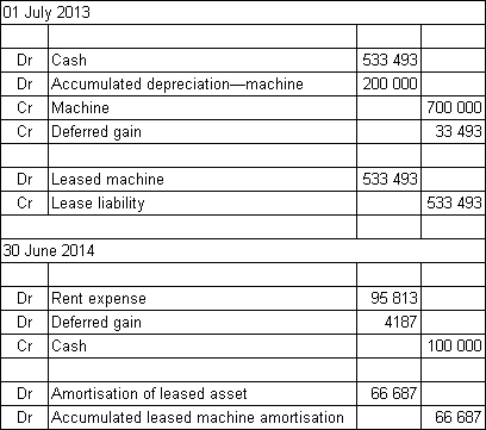

D)

Correct Answer:

Verified

Q21: AASB 117 defines the benefits of ownership

Q22: Fresco Ltd enters into a non-cancellable

Q23: In determining if the risk and rewards

Q24: An operating lease is one in which:

A)

Q25: Johnson Ltd enters into a lease

Q27: Kensington Ltd decides to lease some

Q28: In the case of a finance lease,the

Q29: In circumstances where the lessee is unable

Q30: Where a sale and leaseback arrangement involves

Q31: Mitchum Ltd entered into a lease

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents