Gerbert Ltd enters into a finance lease with Hokiman Ltd on 1 July 2012 for an item of machinery that has a fair value at that date of $226 718.The lease is for a period of 4 years,with annual lease payments of $62 000 due on 30 June each year,the first payment to be made in 2013.There is a bargain purchase option of $15 000 available for Hokiman to exercise at the end of the lease period.The rate of interest implicit in the lease is 6%.It cost Gerbert Ltd $190 000 to manufacture the machine.What are the entries in the books of Gerbert Ltd for 1 July 2012 and 30 June 2013 (round amounts to the nearest dollar) ?

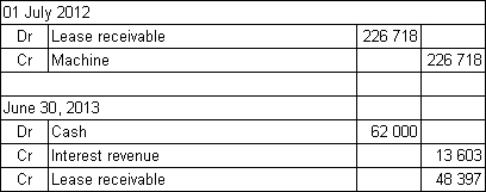

A)

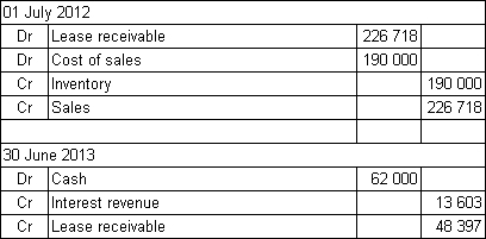

B)

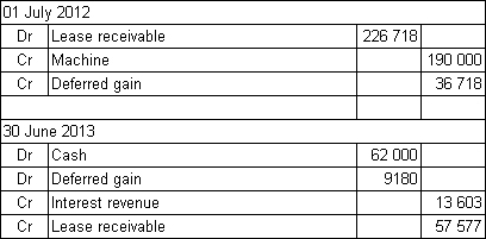

C)

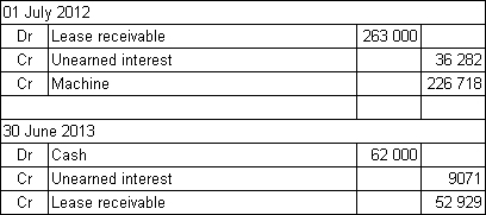

D)

Correct Answer:

Verified

Q37: Cobalt Ltd owns an item of machinery

Q38: A sale and leaseback arrangement may involve

Q39: Quaid Ltd entered into a lease

Q40: The term 'bargain purchase option' is not

Q41: Under AASB 117,operating leases require the following

Q43: A finance lease in which the lessor

Q44: The following journal entry,in the books

Q45: The following journal entry,in the books

Q46: The following is an extract from

Q47: For a lessee entering into a finance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents