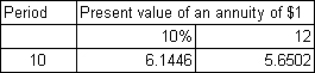

On 1 January 2012 Dobel Ltd signed a 10-year non-cancellable lease that requires a payment of $100 000 at the end of each year.Ownership of the leased asset remains with the lessor at expiry of the lease.The incremental borrowing rate of Dobel Ltd is 12% while the implicit rate of the lessor known to Dobel Ltd is 10%. The following information is also available: At what amount should the leased property be recorded in the books of Dobel Ltd?

At what amount should the leased property be recorded in the books of Dobel Ltd?

A) $0

B) $565 020

C) $614 460

D) $1 000 000

Correct Answer:

Verified

Q71: Discuss the issues raised by the IASB

Q72: At inception of the lease,what is the

Q73: Snowy River Ltd is a lessee to

Q74: Describe how a lessee would account for

Q75: Describe 'lease incentives' and discuss the suggested

Q76: Discuss the presentation and disclosure requirements of

Q78: Paragraph 47 of AASB 117 requires that

Q79: In a lease arrangement that is classified

Q80: Explain the accounting treatment for a lease

Q81: Explain the benefits of a sale and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents