Smith & Jones Ltd owns equipment that was purchased for $56 000 and has accumulated depreciation of $14 000.The following market value information was gathered about the equipment

The equipment has a remaining useful life to the entity of 10 years.What are the appropriate journal entries to record the revaluation under the gross method and the net-amount method?

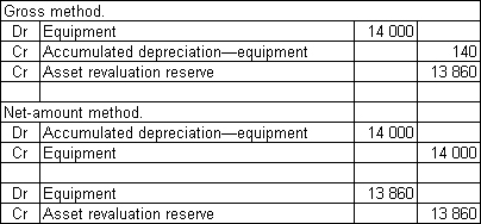

A)

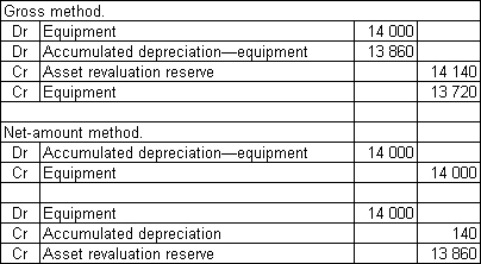

B)

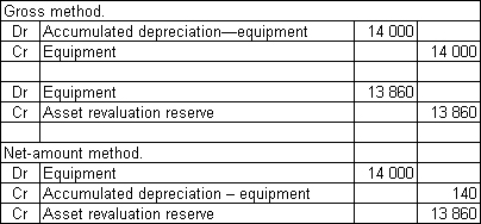

C)

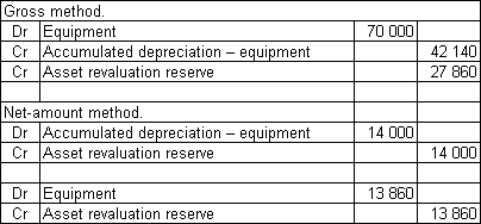

D)

Correct Answer:

Verified

Q32: Once a class of non-current assets has

Q33: Where the value of revalued non-current assets

Q34: Revaluations increments are often a source of

Q35: Seagull Marinas Ltd owns land that was

Q36: Burchells Ltd owns a machine that originally

Q38: Bears and Things acquired a toy-stuffing machine

Q39: Hendersons Ltd has just begun to

Q40: AASB 136 requires that:

A) If a non-current

Q41: Brown,Izan and Loh (1992)found that revaluations are

Q42: AASB 116 permits which of the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents