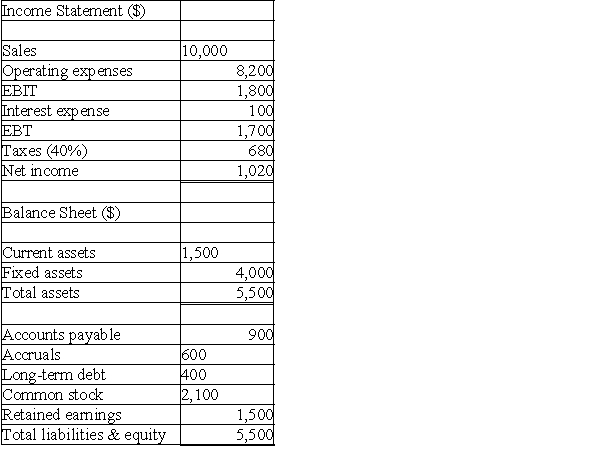

a.Using the financial statements for IUP Enterprises for 2010 (given below),calculate the return on equity,the debt ratio,and the times interest earned ratio.

b.Suppose the industry average debt ratio is 50%.Give one reason why the debt ratio for IUP Enterprises may be considered favorable,and give one reason why the debt ratio for IUP Enterprises may be considered unfavorable.

IUP Enterprises

2010 Financial Statements

Correct Answer:

Verified

Debt Rati...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Which of the following ratios would be

Q114: High Inc.has an accounts receivable turnover ratio

Q115: Please refer to Table 4-5 for the

Q116: Gemini Corp.reported the following balance sheet:

Q119: Please refer to Table 4-5 for the

Q122: Kaylor Corporation increased its financial leverage during

Q123: Complete the following balance sheet using the

Q124: The balance sheet and income statement for

Q125: Please refer to Table 4-7 for the

Q126: Assume that a firm issues a six-month

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents