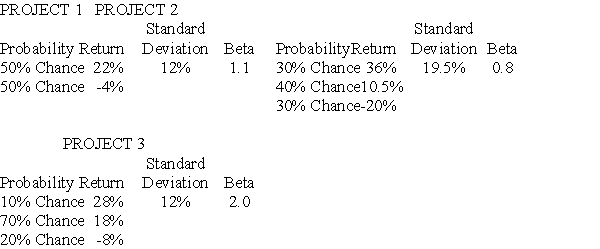

You are going to add one of the following three projects to your already well-diversified portfolio.  Assume the risk-free rate of return is 2% and the market risk premium is 8%.If you are a risk averse investor,which project should you choose?

Assume the risk-free rate of return is 2% and the market risk premium is 8%.If you are a risk averse investor,which project should you choose?

A) Project 1

B) Project 2

C) Project 3

D) Either Project 2 or Project 3 because the higher expected return on project 3 offsets its higher risk.

Correct Answer:

Verified

Q105: If the Beta for stock A equals

Q113: According to the CAPM,for each unit of

Q118: An investor currently holds the following portfolio:

Q121: You determine that XYZ common stock has

Q122: White Company stock has a beta of

Q123: The rate on T-bills is currently 2%.Environment

Q124: Emery Inc.has a beta equal to 1.8

Q125: Stanley Corp.common stock has a required return

Q126: Joe purchased 800 shares of Robotics Stock

Q127: Collectibles Corp.has a beta of 2.5 and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents