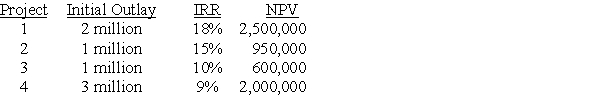

You are in charge of one division of Bigfella Conglomerate Inc.Your division is subject to capital rationing.Your division has 4 indivisible projects available,detailed as follows: If you must select projects subject to a budget constraint of 5 million dollars,which set of projects should be accepted so as to maximize firm value?

If you must select projects subject to a budget constraint of 5 million dollars,which set of projects should be accepted so as to maximize firm value?

A) Projects 1, 2 and 3

B) Project 1 only

C) Projects 1 and 4

D) Projects 2, 3 and 4

Correct Answer:

Verified

Q47: If a project is acceptable using the

Q122: Under what condition would you not accept

Q123: Zellars,Inc.is considering two mutually exclusive projects,A and

Q124: IRR should not be used to choose

Q125: The mutually exclusive project with the highest

Q126: Two projects are mutually exclusive if the

Q127: When capital rationing exists,the divisibility of projects

Q128: The net present value always provides the

Q133: The size disparity problem occurs when mutually

Q137: Capital rationing generally leads to higher stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents