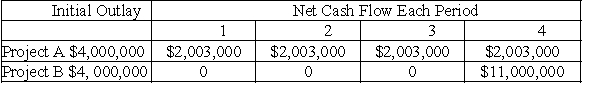

Consider the following two projects:

a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

b.What is the internal rate of return for each of the above projects?

c.Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above.

d.If 14 percent is the required rate of return,and these projects are independent,what decision should be made?

e.If 14 percent is the required rate of return,and the projects are mutually exclusive,what decision should be made?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: If a project is acceptable using the

Q112: A project would be acceptable if

A) the

Q130: Both the profitability index (PI)and net present

Q131: Finance theory suggests that the IRR criterion

Q136: Patrick Motors has several investment projects under

Q139: If a project's IRR is equal to

Q142: Which of the following methods of evaluating

Q143: Given the complications of capital budgeting,it is

Q144: Two potential approaches to capital budgeting decision

Q150: Mutually exclusive projects occur when

A) projects have

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents