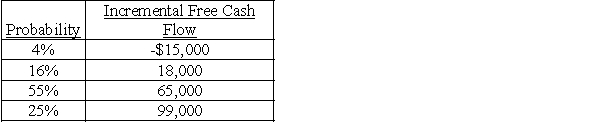

KLE Holdings is considering a capital budgeting project with a life of 7 years that requires an initial outlay of $277,400.The probability distribution for annual incremental cash flows is as follows:

a.The risk-adjusted required rate of return for this project is 12%.Calculate the risk-adjusted net present value of the project and the project's IRR.

a.The risk-adjusted required rate of return for this project is 12%.Calculate the risk-adjusted net present value of the project and the project's IRR.

b.Should the project be accepted?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: The simulation approach provides us with

A) a

Q128: Reducing the probability of bankruptcy is a

Q141: What method is used for calculation of

Q146: Which of the following is NOT an

Q147: Fluctuating currency exchange rates should be ignored

Q149: John Q.Enterprises is considering two potential investments.The

Q149: Advantages of using simulation include

A) adjustment for

Q150: Humongous Corporation is a multidivisional conglomerate.The Food

Q155: Which of the following is not an

Q156: Creighton Industries is considering the purchase of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents