Using the 2010 financial statements for DRE Corporation and this additional information,prepare a pro forma income statement and balance sheet for the year 2011.Determine the discretionary financing needed (DFN)and assume that if the DFN is positive,the company will increase long-term debt,and if DFN is negative,the company will pay back some long-term debt.

Sales for next year (2011)are expected to increase by $300,000 to $1,800,000.The firm is running efficiently and at full capacity so that all assets and spontaneous liabilities are expected to increase proportionally with sales.The dividend payout ratio for 2011 will be 40%.

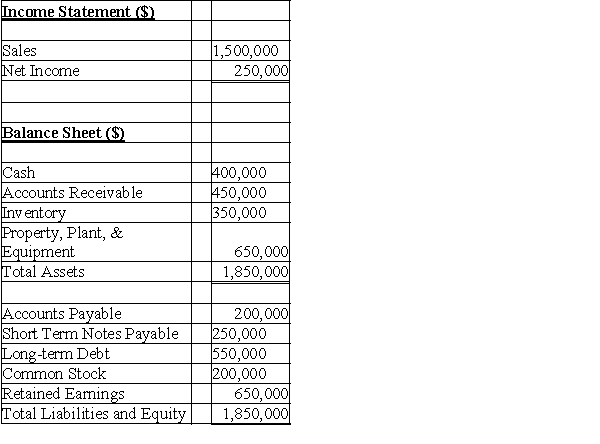

DRE Corporation

2010 Financial Statements

Correct Answer:

Verified

Q41: Which of the following will most likely

Q50: Using the percentage of sales method of

Q59: Fixed assets are often estimated incorrectly by

Q63: Which of the following is a limitation

Q65: Discretionary financing needs will be lower if

Q68: The "percent of sales method" is a

Q70: Use the "percent of sales method" of

Q74: Use the "percent of sales method" of

Q80: Which of the following is the initial

Q97: When economies of scale exist,the percent of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents