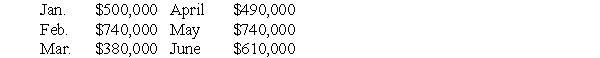

Buster Enterprises' projected sales for the first six months of 2010 are given below: 40% of sales are collected in cash at time of sale,50% are collected in the month following the sale,and the remaining 10% are collected in the second month following the sale.Cost of goods sold is 60% of sales.Purchases are made in the month prior to the sales,and payments for purchases are made in the month of the sale.Total other cash expenses are $40,000/month.The company's cash balance as of February 28,2010 will be $25,000.Excess cash will be used to retire short-term borrowing (if any) .Buster Enterprises has no short term borrowing as of February 28,2010.Assume that the interest rate on short-term borrowing is 1% per month.The company must have a minimum cash balance of $15,000 at the beginning of each month.What is Buster Enterprises' projected cash balance at the end of March 2010?

40% of sales are collected in cash at time of sale,50% are collected in the month following the sale,and the remaining 10% are collected in the second month following the sale.Cost of goods sold is 60% of sales.Purchases are made in the month prior to the sales,and payments for purchases are made in the month of the sale.Total other cash expenses are $40,000/month.The company's cash balance as of February 28,2010 will be $25,000.Excess cash will be used to retire short-term borrowing (if any) .Buster Enterprises has no short term borrowing as of February 28,2010.Assume that the interest rate on short-term borrowing is 1% per month.The company must have a minimum cash balance of $15,000 at the beginning of each month.What is Buster Enterprises' projected cash balance at the end of March 2010?

A) $301,000

B) $329,000

C) $352,000

D) $361,000

Correct Answer:

Verified

Q84: If a firm currently has excess capacity,then

Q96: Mercer,Inc.had the following sales for the past

Q100: Corporation A is expecting sales to increase

Q101: A budget is a forecast of future

Q101: ABC Corporation began operations on January 1st

Q102: Mercer,Inc.had the following sales for the past

Q103: Dorian Industries' projected sales for the first

Q105: Buster Enterprises' projected sales for the first

Q106: JD Enterprises presents income statements for the

Q115: The annual cash budget not only shows

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents