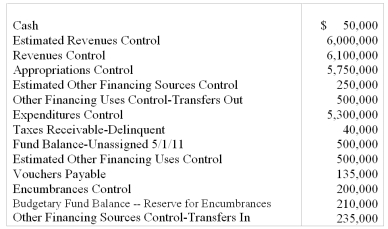

The City of Morganville had the following preclosing account balances in its General Fund as of April 30,2012.Debits and credits are not separated; each account had its "normal" balance.Among the expenditures recorded this year is an amount expended on supplies ordered at the end of the previous year.Assume that encumbrances do not lapse and that the City failed to make the journal entry(s)necessary to re-establish the encumbrance in the current year.

Required:

(a)Prepare all entries necessary to close the General Fund of the City of Morganville.

(b)Prepare a Statement of Revenues,Expenditures,and Changes in Fund Balance for the General Fund for the City of Morganville for the Year Ended April 30,2012.End with the ending fund balance.This is the GAAP operating statement.

Correct Answer:

Verified

Q104: Which of the following General Fund accounts

Q105: $60,000 of property tax owed to the

Q107: Under which fund type would you debit

Q112: Which account would be debited when the

Q119: What is the different accounting treatment with

Q120: Use the following classification to classify each

Q122: The City of Stromfield had the following

Q124: The following transactions occurred in the General

Q125: The following information was available for the

Q126: The City of Smithville was awarded a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents