The Village of Watkins Glenn operated an educational program for at-risk middle school children.Businesses and nonprofit organizations sponsor the children and pay the registration fee.

The following cash receipts were collected:

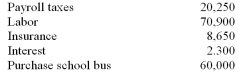

The following cash disbursements were made:

The following cash disbursements were made:

Required:

Required:

A.Prepare the journal entries to record revenues and disbursements if the city treats the

program as an enterprise fund

B.Prepare the journal entries to record revenues and disbursements if the city treats the

program as a special revenue fund

Correct Answer:

Verified

Q123: Describe the accounting required for risk management

Q127: The Water Utility an enterprise fund has

Q128: Which of the following would be found

Q133: Which of the following is not correct

Q135: Which of the following would be an

Q136: In the government-wide statements,enterprise funds are a(n)_

Q137: The City of Carlsbad established a Stores

Q138: An example of an internal service fund

Q141: The following Statement of Cash Receipts and

Q143: As of July 1,2011,the City of Saratoga

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents